Launching an EMI business (Electronic Money Institution) is one of the most strategic moves a fintech company can make in today’s digital economy. However, selecting the right jurisdiction for your EMI business is not just a legal step—it is a foundational decision that can determine your regulatory success, scalability, and long-term credibility. The right jurisdiction supports smooth compliance, efficient licensing, and broad market access. In contrast, the wrong choice can lead to regulatory delays, unexpected costs, restricted operations, and reputational risk.

In this guide, we break down the key jurisdiction factors for an EMI business, explain why each one matters, and share practical insights to help fintech founders, entrepreneurs, and product teams make informed, strategic decisions. From regulatory frameworks and licensing timelines to market access and operational practicality, every factor plays a role in shaping your EMI’s future.

This is not just theory—it’s a practical roadmap designed to help you navigate the complex EMI licensing landscape with clarity and confidence, and to build a compliant, scalable, and future-ready electronic money institution.

What Is an EMI Business and Why Jurisdiction Matters

An EMI business issues electronic money, supports payments, and often provides wallet or cross-border transfer services. Unlike traditional banks, EMIs operate under a lighter regulatory regime, yet the jurisdiction you choose significantly influences operational success.

The chosen jurisdiction affects:

- Regulatory compliance requirements: Each regulator has its own rules, reporting requirements, and auditing standards.

- Licensing costs and timelines: These vary greatly and directly impact cash flow and launch schedules.

- Ability to operate internationally: Some licences provide “passporting” rights across multiple countries.

- Reputation with partners and customers: Banks, payment processors, and investors often assess credibility based on the regulator.

- Tax and corporate structuring: Jurisdiction determines the legal and fiscal framework under which you operate.

Selecting the wrong jurisdiction can create operational headaches, legal risk, and limit your growth potential.

If you’re ready to explore full EMI licensing support, check out our service at 7baas EMI Licensing Services. We help founders navigate regulatory challenges and secure the right authorizations efficiently.

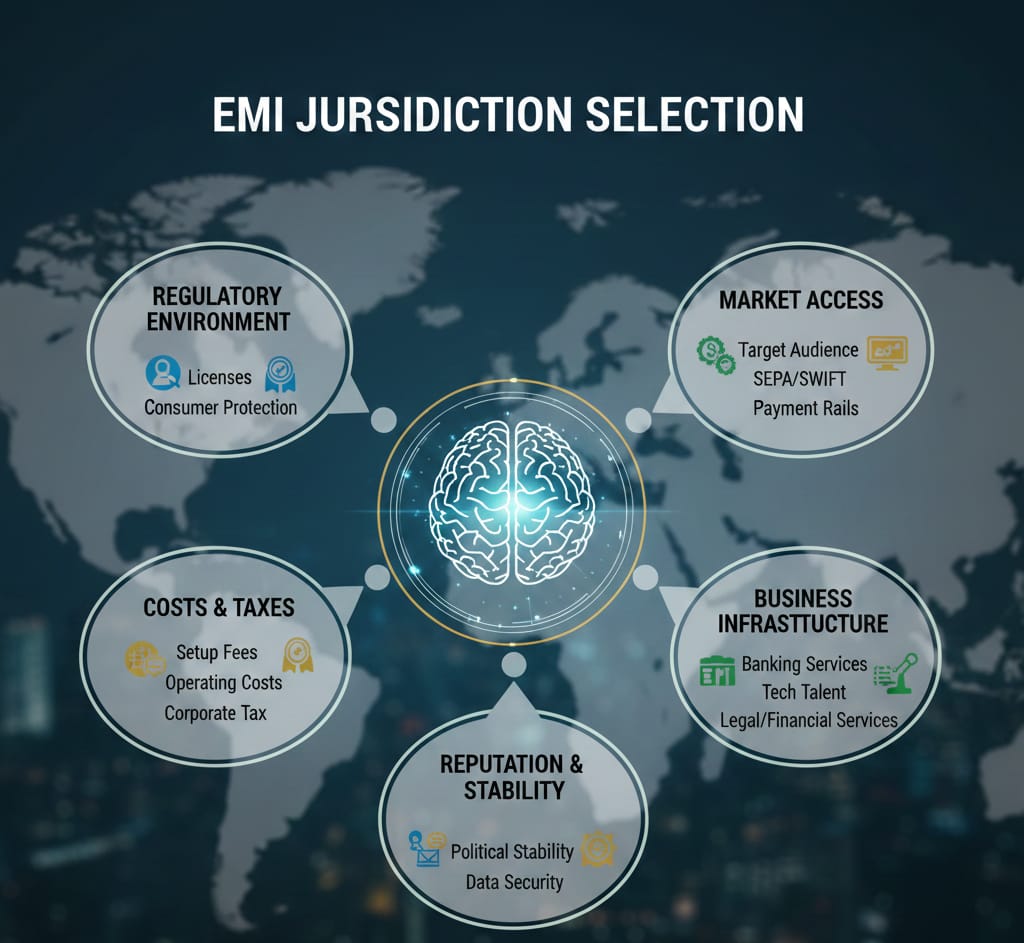

Key Jurisdiction Factors for EMI Business You Must Consider

Starting an EMI business (Electronic Money Institution) is a strategic fintech move, but success heavily depends on selecting the right location to operate. Several jurisdiction factors for EMI business influence regulatory compliance, market access, operational efficiency, and long-term growth. Evaluating these factors early can save costs, reduce legal risks, and boost credibility with partners and customers.

Here’s a detailed guide to the most important jurisdiction factors for EMI business you should consider:

1. Regulatory Environment: A Crucial Jurisdiction Factor for EMI Business

The regulatory environment is arguably the most critical jurisdiction factor for EMI business, as it dictates how smoothly you can establish and operate your EMI entity.

Look for jurisdictions that are:

- Clear and predictable: Regulations and licensing requirements should be published and easy to follow.

- Stable over time: Avoid regions where rules change frequently, creating uncertainty.

- Fairly enforced: Regulators should be approachable, consistent, and transparent.

- Aligned with international standards: Compliance with FATF, Basel, and other global guidelines facilitates cross-border operations.

Examples of strong EMI jurisdictions: EU (Lithuania, France, Germany), UK, Singapore, Australia, United States.

For global regulatory standards, see the FATF – Financial Action Task Force website.

2. Licensing Costs and Time to Approval: Essential Jurisdiction Factors

Licensing costs and approval timelines are among the most practical jurisdiction factors for EMI business. They directly affect your budget, cash flow, and speed to market.

Direct Costs Include:

- Application fees: Vary by jurisdiction. The UK FCA charges based on the size and type of EMI, whereas some EU countries like Lithuania have lower fees but additional compliance costs.

- Capital requirements: Minimum capital ensures operational stability and customer fund protection. Requirements range from €350,000 to over €1,000,000 depending on the jurisdiction.

- Legal and consultancy fees: Expert guidance is required to prepare applications, business plans, and regulatory documentation.

- Operational compliance infrastructure: AML/KYC systems, reporting software, internal audit processes, and safeguarding mechanisms.

Time to Approval:

- Approval timelines can range from 3 months to over a year, depending on jurisdiction and preparation.

- Jurisdictions with fintech innovation programs or sandboxes, like UK FCA Sandbox or MAS Singapore FinTech Innovation Hub, often provide faster processing.

Tip: Choose jurisdictions with structured approval processes to reduce costs, avoid delays, and accelerate your market entry.

3. Market Access and Passporting Rights: Key Jurisdiction Factors

Market access defines where your EMI can legally operate, making it a vital jurisdiction factor for EMI business.

- EU EMI licence: Allows passporting across all EEA countries, enabling multi-country operations without separate approvals.

- UK EMI licence: Covers the UK; post-Brexit, additional approvals are needed to operate in the EU.

- Singapore & Australia: Provide regional access but limited global reach.

Additional Considerations:

- Regulatory differences can impact product offerings, pricing, and compliance reporting.

- Passporting rights are critical for cross-border payments, digital wallets, and international partnerships.

- Evaluate whether target markets are fintech-friendly and have mature payment ecosystems.

Tip: Map your target markets before selecting a jurisdiction to ensure your EMI licence aligns with long-term growth goals.

4. Reputation and Perception: Influential Jurisdiction Factors for EMI Business

The regulator’s global reputation significantly impacts credibility, partnerships, and investor confidence—making it an essential jurisdiction factor for EMI business.

- FCA UK: Recognized worldwide as a high-standard regulator.

- MAS Singapore: Strong oversight and gateway to Asia.

- Lithuania: Emerging fintech hub with favorable costs and growing recognition.

Being licensed in a respected jurisdiction builds trust, attracts high-value partners, and often eases access to banking and payment service providers.

5. Capital and Liquidity Requirements: Important Jurisdiction Factors for EMI Business

Capital and liquidity obligations are crucial jurisdiction factors for EMI business, ensuring your EMI can operate sustainably while safeguarding customer funds:

- EU (Lithuania): ~€350,000 minimum capital.

- UK FCA: Higher depending on business type.

- Singapore: SGD 250,000–500,000 for stored value facilities.

Ensure your business can comfortably meet both initial and ongoing capital requirements to maintain regulatory compliance and operational stability.

6. Tax and Corporate Structures: Strategic Jurisdiction Factors for EMI Business

Tax and corporate planning are key jurisdiction factors for EMI business that influence long-term cost-efficiency and legal compliance:

- Corporate tax rates: Lower taxes reduce operating expenses.

- Withholding taxes: Can affect international revenue.

- Double Taxation Treaties: Prevent paying tax twice on cross-border earnings.

- Holding company frameworks: Useful for global expansion.

⚠️ Tip: Select a jurisdiction that complements your regulatory strategy and market goals, rather than choosing solely for tax savings.

7. Local Partnerships and Ecosystem: Operational Jurisdiction Factors for EMI Business

A robust fintech ecosystem is another essential jurisdiction factor for EMI business, providing operational support and reducing friction:

- Banking partners: Needed for payment processing.

- Payment processors: Facilitate faster transactions.

- KYC/AML vendors: Ensure compliance and risk management.

- Talent pool: Access to fintech, legal, and operational experts.

Strong local ecosystems accelerate product launch, regulatory compliance, and scaling.

8. Language, Communication, and Operational Practicalities: Jurisdiction Factors for EMI Business

Operational efficiency is a critical jurisdiction factor for EMI business:

- Are regulatory documents available in English?

- Can your team easily communicate with authorities?

- Does time-zone alignment support smooth operations?

Even small inefficiencies can delay approvals, increase costs, and complicate daily operations.

9. AML/KYC Standards and Enforcement: Compliance Jurisdiction Factors for EMI Business

Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance is a fundamental jurisdiction factor for EMI business:

- High standards may slow initial onboarding but reduce long-term regulatory and reputational risks.

- Low standards may speed setup but increase exposure to legal scrutiny and compliance failures.

Choosing a jurisdiction with clear AML/KYC requirements ensures long-term stability and trust with banks, partners, and customers.

10. Data Protection and Customer Privacy

Data privacy laws are another essential jurisdiction factor for EMI business:

- EU GDPR: Strong data protection laws mandatory for EU EMIs.

- Singapore PDPA: Enforces privacy standards for APAC markets.

- Some jurisdictions require local data residency, affecting IT infrastructure.

Strong, predictable data protection laws safeguard your business legally and enhance customer trust.

11. Technological Infrastructure and Innovation Support: Modern Jurisdiction Factors for EMI Business

Technology is the backbone of EMIs. Jurisdictions that support fintech innovation provide a competitive edge:

- Regulatory sandboxes for testing products pre-launch.

- Guidance on digital wallets, open banking, and blockchain.

- API-friendly frameworks for financial services integration.

Examples: UK FCA Sandbox, MAS Singapore FinTech Innovation Hub. Leveraging these programs reduces risk and accelerates time-to-market.

12. Political and Economic Stability: Long-Term Jurisdiction Factors

Political and economic conditions can significantly affect EMI operations, making them vital jurisdiction factors for EMI business:

- Unstable political environments may trigger sudden regulatory changes.

- Economic uncertainty affects banking reliability and partnerships.

- Currency volatility may impact cross-border operations.

Select jurisdictions with stable governance and predictable financial systems for sustainable long-term operations.

Popular EMI Jurisdictions: Pros and Cons

| Jurisdiction | Pros | Cons |

|---|---|---|

| United Kingdom (FCA) | – Strong global reputation – Well-established banking ecosystem – Access to UK fintech network | – Higher capital requirements – Post-Brexit, EU market access is limited |

| European Union (Lithuania, France, Germany) | – EEA passporting for multi-country operations – Clear fintech regulations – Cost-effective licensing in some countries | – GDPR compliance adds complexity – Licensing and requirements vary by member state |

| Singapore | – Gateway to APAC markets – Strong regulatory clarity – Innovation-friendly environment with fintech sandboxes | – Licensing process may require local partners – Moderate capital thresholds |

| Australia | – Stable regulatory and economic environment – Clear licensing paths – Access to Asia Pacific markets | – Market size smaller compared to EU or UK – May require additional licenses for cross-border operation |

Common Mistakes to Avoid

- Choosing solely based on cost: Cheaper jurisdictions may compromise reputation.

- Ignoring market access: A licence without passporting limits growth.

- Underestimating compliance: AML/KYC and reporting can be operationally heavy.

- Neglecting long-term scalability: Consider capital growth, partnerships, and tech infrastructure.

- Failing to assess operational practicality: Time zone, language, and legal support matter.

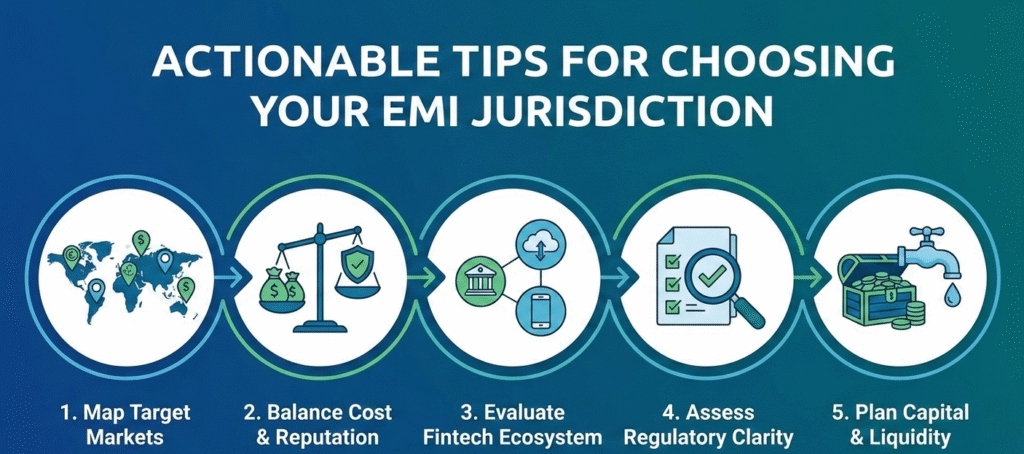

Actionable Tips for Choosing Your EMI Jurisdiction

- Map your target markets first: Decide where you want to operate long-term.

- Balance cost and reputation: Don’t sacrifice credibility for cheap licensing.

- Evaluate fintech ecosystem: Strong partners reduce operational hurdles.

- Assess regulatory clarity: Choose jurisdictions with published guidelines and support channels.

- Plan capital and liquidity strategy: Ensure sustainability beyond the initial launch.

For step-by-step guidance, our EMI Licensing Service helps navigate these decisions efficiently.

Conclusion: Selecting the Right Jurisdiction for Long-Term Success

The jurisdiction you select for your EMI business is more than a legal formality — it defines your business identity, market reach, and operational strategy. A strong regulator boosts credibility, facilitates international expansion, and helps secure partnerships. Cost, capital, operational practicality, and market access all play critical roles.

Make your decision strategically, considering both immediate needs and long-term growth. Use frameworks, compare jurisdictions, and prioritize compliance, reputation, and passporting benefits.

Launching your EMI successfully begins with the right foundation. And that starts with choosing the right jurisdiction.

Ready to take the next step? Explore how we help fintech founders secure EMI licences efficiently at 7baas EMI Licensing Services.

1. Can an EMI operate in multiple countries with a single licence?

Yes, but only if the licence provides passporting or cross-border recognition. For example, an EU-issued EMI licence allows passporting across the EEA, while UK, Singapore, or Australia licences may require additional authorisations for foreign markets. Always assess cross-border permissions before selecting a jurisdiction for your EMI business.

2. Is it possible to change an EMI licensing jurisdiction after approval?

Changing the licensing jurisdiction after approval is complex and costly. It often requires re-licensing, regulatory notifications, and restructuring of operations. That’s why selecting the right jurisdiction at the start is critical for long-term scalability and cost control.

3. Do all jurisdictions require a physical office for an EMI business?

No, requirements vary by jurisdiction. Some regulators require a local physical presence, including a registered office and local staff, while others allow remote operations with local representatives. This operational requirement should be evaluated as part of your jurisdiction factors for EMI business.

4. How long does an EMI licence remain valid?

Most EMI licences do not expire, but they require ongoing compliance, periodic reporting, audits, and capital maintenance. Failure to meet regulatory obligations can lead to licence suspension or revocation, regardless of jurisdiction.

5. Can startups apply for an EMI licence, or is prior financial history required?

Startups can apply for an EMI licence in many jurisdictions. Regulators typically focus on business plans, governance structure, compliance readiness, and management expertise rather than long operating history. However, strong financial projections and experienced leadership improve approval chances.

6. Does jurisdiction selection affect banking and payment partnerships?

Absolutely. Banking partners and payment processors often prefer EMIs licensed in well-regulated, reputable jurisdictions. Choosing a strong regulatory jurisdiction can significantly reduce friction when opening safeguarding accounts or integrating payment services.