Introduction

In the intricate world of financia services, compliance is not merely a prerequisite- it is the backbone of a viable and reputable business. In the case of MSBs, this involves working through an incredibly important, yet often misregarded, procedure; MSB registration.

This detailed guide will offer a complete subdivision of the process of MSB registration, including learning whether you need to register and the particular procedure and documents you need to submit. This article provides everything you need to know about fintech compliance whether you are a startup or a well-established business that is expanding the range of its services.

What is an MSB and Why Do You Need to Register?

Before diving into the “how,” it’s crucial to understand the “what” and the “why.”

What is an MSB?

A Money Services Business (MSB) is a broad term used by regulatory bodies like the Financial Crimes Enforcement Network (FinCEN) in the United States and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) to classify businesses that provide specific financial services. This can include:

- Money Transmitters: Companies that transfer funds on behalf of the public, regardless of the amount. This is a key category and applies to many fintech companies.

- Currency Dealers or Exchangers: Businesses that exchange one currency for another (e.g., a currency exchange booth) and whose transactions exceed a certain daily threshold.

- Check Cashers: Companies that will cash a number of checks on behalf of a customer past a certain amount within a day.

- Issuers, Sellers, or Redeemers of Money Orders or Traveler’s Checks: Companies that are involved with issuing, selling or redeeming these types of documents beyond a specific amount of money.

- Providers and Sellers of Prepaid Access (formerly Stored Value): This covers enterprises that issue, sell or redeem stored-value cards or other products.

It should be mentioned that certain thresholds and definitions are different and may vary according to a jurisdiction. In the U.S. many such activities are subject to a transaction threshold of more than $1,000 per person, per day, but the category of money transmitter has no transaction threshold.

Why is Registration Mandatory?

MSB registration is one of the fundamental elements of the global anti-money laundering and counter terrorist financing functions. By registering, a business is transformed by the law into a financial institution, thus ranking it among the financial institutions subject to stringent reporting and recordkeeping obligations.

The initial aims are:

- Stop Financial Crime: By registering, government authorities can trace financial transactions to ensure that financial crimes become harder to commit, laundering funds or withholding funds becomes harder.

- Bring in Transparency: It makes it an open and transparent financial environment where the businesses have to take their own transactions and client activity at encounter.

- Develop Credibility: A registered MSB is able to gain the credibility of its customers, business affiliates, and financial institutions that indicates that it operates within the law and has a compliance commitment.

Even the omission to register at the designated period may end up attracting serious civil and criminal consequences in the form of huge fines and even jail terms

The Step-by-Step MSB Registration Process

While the specific forms and platforms may differ between countries, the general process for MSB registration follows a clear, logical flow.

Step 1: Determine Your Registration Obligations

The first and most critical step is to determine if your business activities require you to register as an MSB.

- Self-Assessment: Carefully review the definition of an MSB in your jurisdiction. This includes a detailed analysis of your business model, the services you offer, and the volume and nature of your transactions.

- Identify Exemptions: Be aware of any exemptions. For instance, a business that acts solely as an agent of another registered MSB (e.g., a convenience store selling money orders for a major money transmission company) may not need to register on its own behalf.

Step 2: Appoint a Compliance Officer and Develop an AML Program

Before you even fill out a form, you must have an established compliance framework.

- Appoint a Compliance Officer: This individual will be responsible for overseeing the business’s AML program and ensuring adherence to all regulations.

- Develop a Robust AML Program: This program is the cornerstone of your compliance efforts. It must be in writing and tailored to your business’s specific risks. A strong AML program typically includes:

- Internal Controls: Policies and procedures to ensure compliance.

- Designated Compliance Officer: A person responsible for the program.

- Training: Ongoing training for all relevant employees.

- Independent Review: A periodic (e.g., every two years) independent review to test the program’s effectiveness.

Step 3: Gather Required Information and Documentation

The registration application requires a wealth of information about your business, its owners, and its operations. Be prepared to provide:

- Company Information: Legal name, “doing business as” names, physical address, and contact details.

- Business Activities: A detailed description of the MSB services you provide and the states or regions in which you operate.

- Ownership and Management: Information on the owners, partners, and senior management, including their names, dates of birth, and identification. In some jurisdictions, a police record check may be required for key individuals.

- Financial Information: An estimate of the expected total dollar amount of transactions per year for each MSB service.

- Agents and Branches: A list of all agents and branches you have.

Step 4: File the Registration Form

This is the formal submission of your application.

- Electronic Filing: Most jurisdictions, including FinCEN in the U.S. and FINTRAC in Canada, strongly encourage or even require electronic filing through a secure online system. This is often the fastest and most reliable way to submit your application.

- Form Details: The form (e.g., FinCEN Form 107 in the U.S.) will require you to enter all the information you gathered in the previous step. It’s critical to be accurate and thorough.

Step 5: Await Approval and Receive Your Registration Number

After submission, the regulatory body will process your application.

- Review and Clarification: They may review your application and request further information or clarification. Promptly and accurately responding to these requests is essential to avoid delays.

- Approval: Once approved, you will be issued a unique MSB registration number. This number is your official seal of approval and demonstrates your legal standing.

Country-Specific MSB Registration Overviews

The general process outlined above is a global standard, but the specific requirements and regulatory bodies vary significantly by country.

MSB Registration in the USA

In the United States, MSB registration is composed of two levels, the federal and the state level.

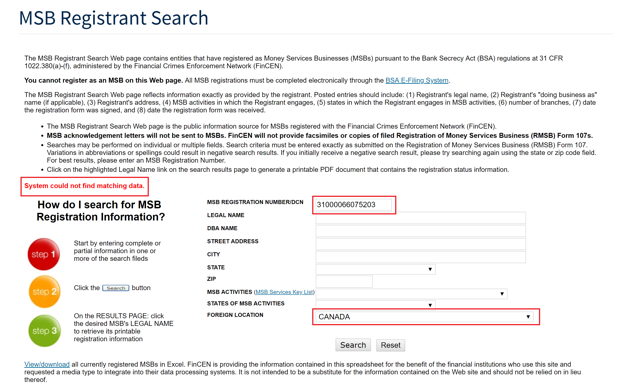

- Federal Requirement (FinCEN): All MSBs are required to register with the Financial Crimes Enforcement Network (FinCEN) which is a part of the U.S treasury. This happens by filing FinCEN Form 107 by the BSA E-Filing System. This is a requirement of all businesses that are subject to the registration though not all businesses require the state license. It shall be re-registered after every 2 years period

- State-Licensing: State-level licensing is also required in nearly all states of the United States. This is most times the most complicated and time consuming parts of the process. Each state has widely different requirements; however, they often consist of a surety bond, minimum net worth, business plan and criminal background checks on key personnel. A business that has operations in more than one state will have to acquire a license in each state in which it is to operate.

Ready to Register? Contact Us Now

MSB Registration in Canada

In Canada, the primary regulatory body for MSBs is the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

- FINTRAC Registration: Businesses that qualify as MSBs or Foreign Money Services Businesses (FMSBs) must register with FINTRAC. This is a critical first step and must be completed before you begin operations.

- Key Requirements: FINTRAC’s registration process is straightforward but requires a robust internal framework. Applicants must:

- Have a physical presence in Canada (for MSBs) or serve Canadian clients without a physical presence (for FMSBs).

- Appoint a designated compliance officer.

- Develop and implement a written AML compliance program.

- Provide detailed information about the company’s business activities, owners, and senior management.

- No Minimum Capital: Unlike many other jurisdictions, FINTRAC does not impose a minimum capital requirement for registration, which can make it a more accessible market for startups.

MSB Registration in the UK

In the United Kingdom, the primary authority for MSB registration is Her Majesty’s Revenue & Customs (HMRC), which supervises the business for compliance with anti-money laundering regulations.

-

- HMRC Supervision: Businesses that provide money services, such as currency exchange or money transmission, must register with HMRC.

- Two-Part Process: The registration often involves two key elements:

- HMRC Registration: This is the core application with HMRC, where you provide details about your business and its activities. This includes a “fit and proper” test for all responsible persons (directors, owners, etc.).

- Financial Conduct Authority (FCA) Authorization: Many MSB activities, particularly those involving money transmission and electronic money, also require authorization from the Financial Conduct Authority (FCA) under the Payment Services Regulations 2017. While HMRC handles the AML supervision, the FCA provides the legal permission to operate as a payment service provider.

Post-Registration Compliance

However, registration is not an event, but rather the start of an ongoing compliance process.

-

-

- Renewing Your Registration: The process of registration of MSB requires a periodical renewal (e.g., every two years in the U.S.). Circle the date on your calendar and don’t forget to re-register with your deadline.

- Record Keeping: You are required to retain any back up documentations including a copy of your filed registration form and an up to date list of your agents within a specified time (e.g. five years).

- Required Reports: Being a registered MSB, now you are bound to file a number of various reports, including:

- Currency Transaction Reports (CTRs): In respect of cash transactions above a certain threshold.

- Suspicious activity reports (SARs): Suspicious activity or any transaction or series of transactions you suspect.

- Information: If your business changes significantly, you must change your registration with the regulatory body (this could be a change of ownership, address or business activities).

-

FAQs

Q1: What is a Registered MSB?

An MSB (Money Services Business) is a company that moves, exchanges, or converts money. Under the Bank Secrecy Act (BSA), MSBs are treated as financial institutions and must follow anti-money laundering (AML) rules.

Q2: What does MSB mean in trading?

In trading, MSB stands for Market Structure Break. It signals a change in trend, such as moving from an uptrend to a downtrend or from consolidation into a new trend.

Q3: What does MSB stand for?

MSB usually means Money Services Business. This includes services like currency exchangers, check cashers, and money transmitters.

Q4: What is MSB compliance?

MSB compliance means following AML regulations to prevent money laundering and financial crimes. It applies to businesses like fintechs, neobanks, and cryptocurrency platforms.

Conclusion

The process of registering a MSB may appear to be overwhelming, nevertheless, it is one of the steps that cannot be dismissed in a business in this industry. By properly learning the requirements, planning carefully, and being willing to adhere thoroughly to them in the long-term, you not only avoid any fees but also develop a secure, legal and trusted business that will well be poised to grow long term.