Choosing the right fintech license is one of the most critical decisions for any startup. The license you select—MSB, EMI, or VASP—determines your ability to operate legally, hold customer funds, partner with banks, and expand globally. Making the wrong choice can result in regulatory fines, operational delays, or blocked partnerships.

This guide explains the differences between MSB, EMI, and VASP licenses, key decision factors, jurisdictional considerations, and how 7BaaS support helps fintech founders obtain the right licensing and compliance framework.

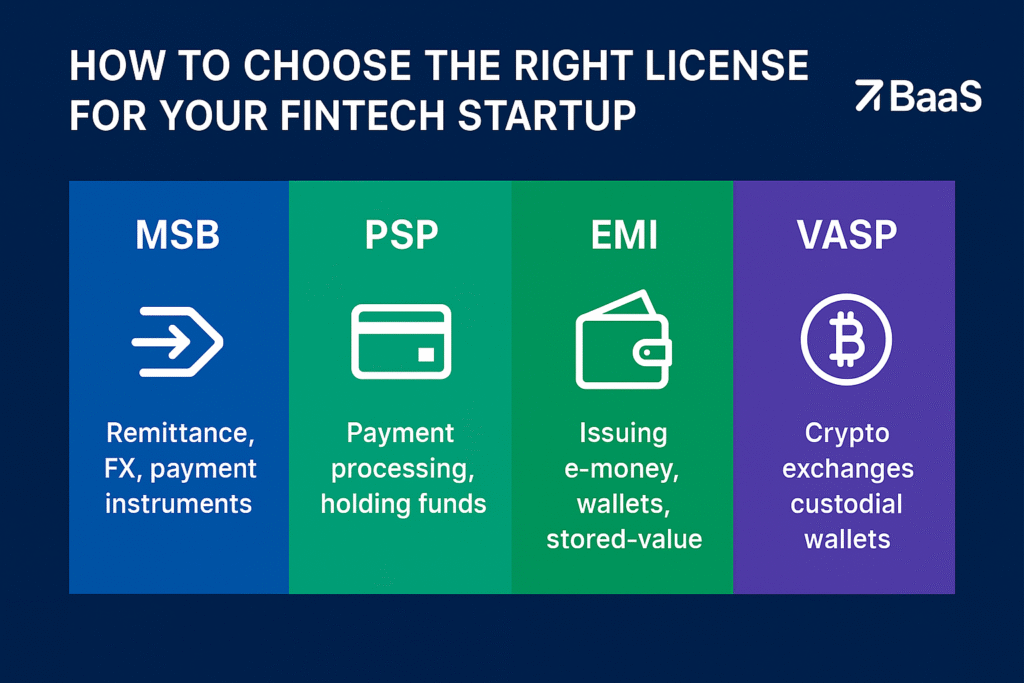

Understanding Core Fintech License Types (MSB, EMI, VASP)

Fintech licensing can seem overwhelming at first. Here are the three main license types most startups need to consider:

Money Services Business (MSB) License for Fintech Startups

An MSB registration typically covers basic money transfer activities, such as:

- Domestic and cross-border remittances

- Foreign exchange (FX) services

- Issuance or redemption of payment instruments

In some jurisdictions, crypto-related activities—like OTC trades or transfers on behalf of clients—also fall under MSB rules. MSB registration is often faster and cheaper than full authorization as an EMI or VASP.

Pros:

- Quick registration (weeks to a few months)

- Lower upfront costs

- Less operational complexity

Cons:

- Cannot hold significant client funds in wallets

- Limited credibility for banking and partnerships

- Not suitable for multi-service fintechs or crypto-heavy operations

Typical use cases: Remittance platforms, FX services, agent networks, some crypto OTC desks

Authoritative references: FINTRAC: Money Services Businesses (Canada), FinCEN: MSB Registration (U.S.)

Electronic Money Institution (EMI) License Explained

EMI licenses allow a firm to issue e-money, operate wallets, and provide payment services, while following strict safeguarding and capital requirements. EMI authorization is common in the UK/EU and is ideal for fintechs that plan to store customer funds, issue prepaid cards, or operate digital wallets.

Pros:

- Strong credibility with banks and partners

- Ability to hold customer funds in wallets or accounts

- Access to broader financial products and partnerships

Cons:

- Longer lead times (several months to a year)

- Higher capital and operational readiness requirements

- Compliance obligations are more intensive

Typical use cases:

- Digital wallets storing fiat

- Neobank products

- Prepaid card issuers

Authoritative references: FCA: Electronic Money Regulations, European Central Bank PSD2 Overview

Virtual Asset Service Provider (VASP) License Guide

VASP licenses apply to businesses that deal with virtual assets, such as:

- Crypto exchanges

- Custodial wallets and private key management

- Fiat-to-crypto and crypto-to-fiat on/off ramps

VASP licensing follows FATF guidance, including:

- AML/KYC compliance

- Travel Rule implementation

- Risk-based transaction monitoring

Pros:

- Legally authorized to operate crypto services

- Increased trust from clients and banking partners

Cons:

- Heavy compliance requirements

- Regulations vary by jurisdiction and are evolving

- High operational and technical readiness needed

Typical use cases:

- Crypto exchanges

- Custodial wallets

- Tokenization platforms

Authoritative references: FATF Guidance on Virtual Assets & VASPs, FCA: Cryptoasset Business Registration

MSB vs EMI vs VASP — Comparison Table

| Feature / Criteria | MSB (Money Services Business) | EMI (Electronic Money Institution) | VASP (Virtual Asset Service Provider) |

|---|---|---|---|

| Primary Activity | Remittance, FX, payment instruments | Issuing e-money, wallets, stored-value services | Crypto exchanges, custodial wallets, tokenization |

| Hold Customer Funds | No | Yes | Yes |

| Issue e-money / Cards | No | Yes | Sometimes (crypto-backed) |

| Crypto Operations | Limited (OTC / transfers) | Limited | Core activity |

| Regulatory Oversight | FINTRAC (Canada), FinCEN (US) | FCA (UK), ECB (EU) | FATF, Local crypto regulators |

| Compliance Burden | Low | Medium | High |

| Banking & Partner Credibility | Moderate | High | High |

| Typical Use Cases | Remittance platforms, FX services, agent networks | Digital wallets, neobanks, prepaid cards | Crypto exchanges, custodial wallets, tokenization platforms |

| Cost & Timeline | Low, fast (weeks) | Higher, longer (months to year) | High, variable depending on jurisdiction |

| Best For | Simple transfers and FX | Wallets, prepaid services, fintech scaling | Crypto trading, custody, tokenized assets |

Key Factors to Decide the Right Fintech License

When choosing a fintech license, founders should evaluate five core factors:

- Core Product & User Flows:

Identify all activities: storing fiat/crypto, converting currencies, remitting funds, processing payments, issuing cards. Holding client funds or controlling keys typically requires EMI or VASP. - Geographic Footprint:

Operations in certain jurisdictions require local registration. Example: Payment service providers in Canada must register with the Bank of Canada. - Banking & Partnerships:

Banks prefer regulated entities with EMI or VASP licensing. MSB is often enough for remittance or FX, but wallets and multi-service fintechs require stronger licenses. - Compliance Burden vs Speed to Market:

- MSB = faster, cheaper entry

- EMI/VASP = heavier compliance, slower approval, but broader services

- Budget & Capital Requirements:

EMIs need significant capital and operational readiness. VASPs require technical systems for wallets, custody, and blockchain monitoring.

How 7BaaS Support Helps Fintech Founders

7BaaS provides end-to-end support to ensure your fintech launches legally and scales safely:

- Consultation & Strategy: Assess product, market, and growth plan to recommend the optimal license.

- Jurisdiction Selection: Identify countries suitable for MSB, EMI, or VASP registration.

- Documentation & Application Support: Draft business plans, AML/KYC manuals, financial projections, and regulatory submissions.

- Compliance & Technical Framework: Implement operational controls, wallet/custody architecture, KYC/AML systems, and secure infrastructure.

- Banking & Partner Integration: Guidance on connecting with banks, card issuers, and payment partners.

- Buy/Sell Licensed Entities: Acquire pre-licensed entities for faster market entry with compliance handover.

Learn more: 7BaaS Services

Step-by-Step Implementation Roadmap

- Define Product Scope & User Flows

- Select Jurisdiction

- Build Compliance Foundation (AML/KYC manuals, sanctions screening)

- Prepare Technical & Security Documentation (wallet design, custody model)

- Financials & Governance (proof of capital, fit-and-proper checks)

- Submit Application & Engage Regulator

- Banking & Partnerships Onboarding

Common Pitfalls & How to Avoid Them

- Underestimating AML/KYC requirements: implement from day one

- Weak custody & technical controls: use robust multi-party custody solutions

- Poor documentation: regulators expect clear, tested policies

- Waiting on banking relationships: banks onboard regulated entities with full compliance

Practical Takeaways

- MSB: Quick, cost-effective for remittance/FX, limited client fund handling

- EMI: Necessary for wallets and stored-value services, improves banking credibility

- VASP: Required for regulated crypto operations, ensures legal compliance and customer trust

By understanding these differences and leveraging 7BaaS support, founders can choose the right fintech license to launch legally, scale confidently, and implement compliant operations from day one.