What’s an EMI?

An Electronic Money Institution (EMI) can issue e-money and provide payment services across the EEA via passporting. Authorisation is national, but prudential standards are harmonised under EU law (EMD2/PSD2). The EBA Authorisation Guidelines standardise what goes into applications.

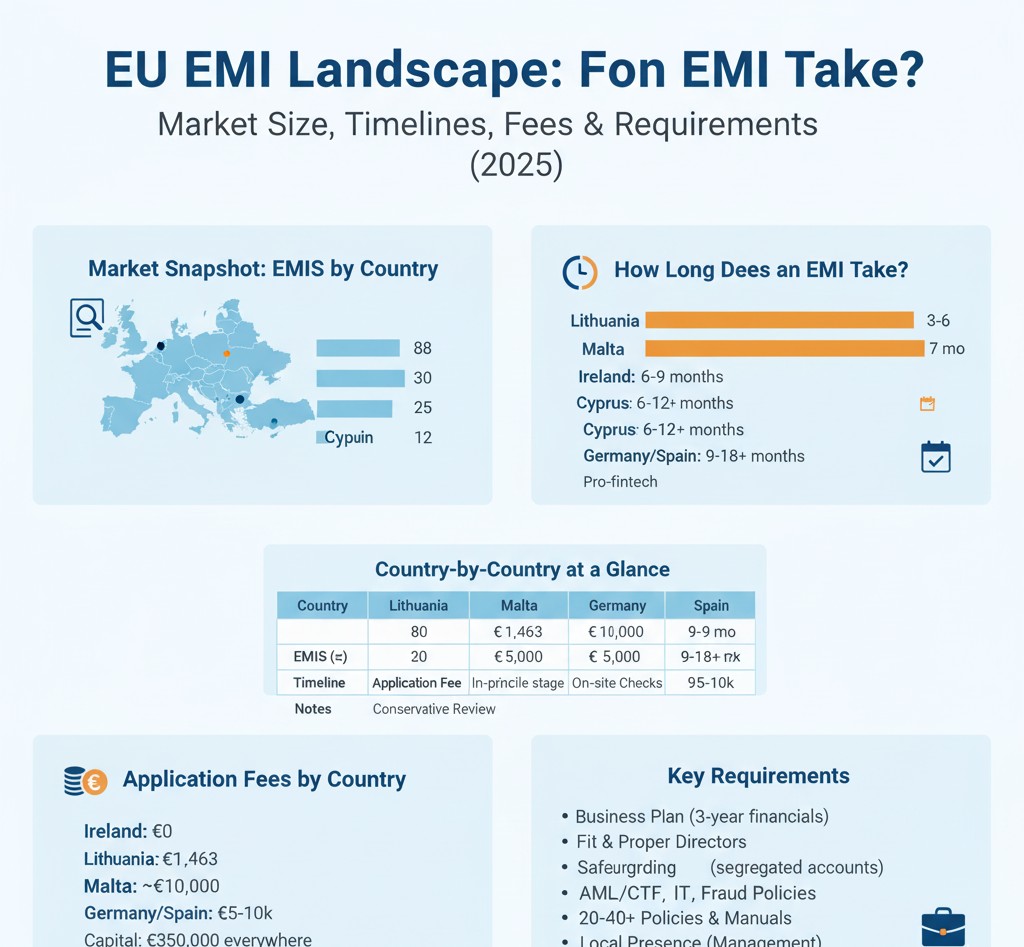

Market Snapshot: EMIs by Country

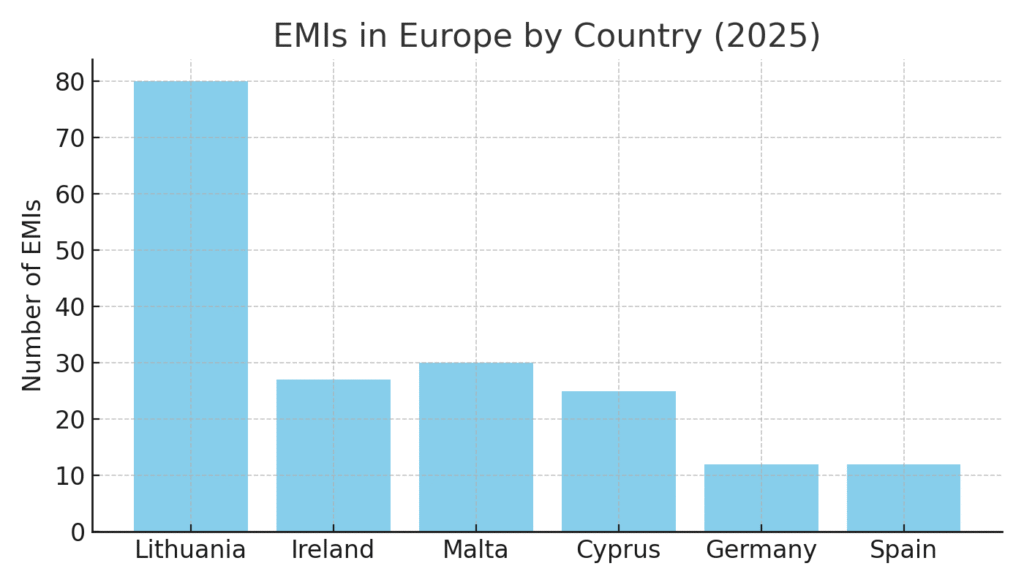

Current EMI counts by country (approximate, based on national registers and compiled lists):

– Lithuania: 80 EMIs supervised (largest hub).

– Ireland: ~27–28 EMIs.

– Malta: ~30 EMIs.

– Cyprus: ~25 EMIs.

– Germany: ~12 EMIs.

– Spain: ~12 EMIs.

Figure: Number of EMIs by country (2025).

Who’s Most Pro-EMI?

Lithuania stands out: published 3-month review goal for complete EMI files, proactive fintech strategy, and SEPA access via CENTROlink. Ireland is strong too but emphasises a more cautious, risk-based approach.

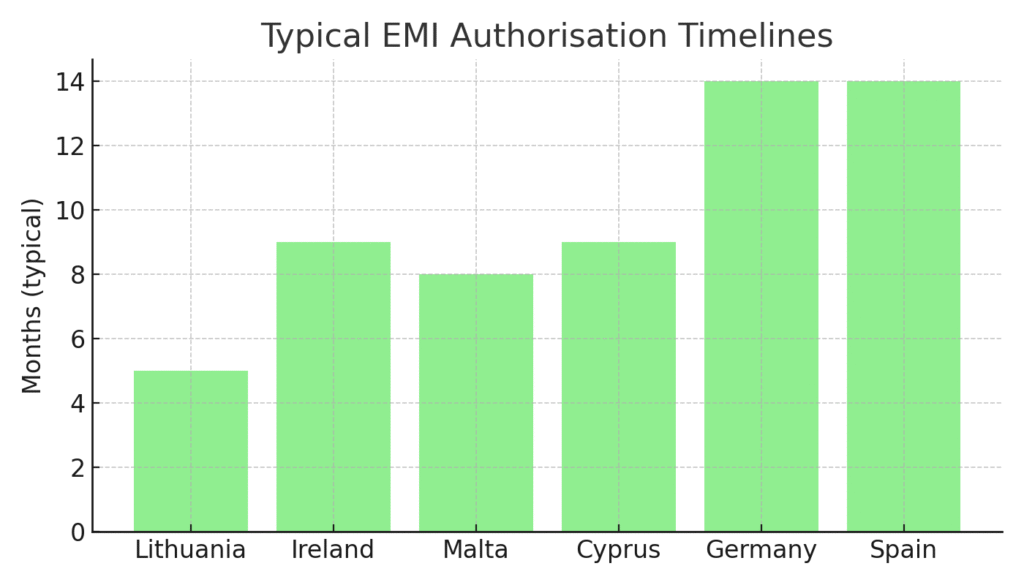

How Long Does an EMI Take?

Typical authorisation timelines:

– Lithuania: ~3–6 months.

– Ireland: ~6–12+ months.

– Malta: ~6–9 months.

– Cyprus: ~6–12+ months (3 months once file complete).

– Germany/Spain: ~9–18+ months.

Figure: Typical EMI authorisation timelines by country.

Application Fees by Country

Application fees vary by jurisdiction (prudential capital for full EMI is €350,000 everywhere):

– Ireland: €0.

– Lithuania: €1,463 (EMI) / €1,235 (small EMI).

– Cyprus: €5,000 (+€1,000 per added payment service).

– Malta: ~€10,000 (revised 2025, older €3,500).

– Germany/Spain: typically €5,000–10,000 equivalent.

Special Country Wrinkles

– Lithuania: Pro-fintech stance, CENTROlink, transparent playbook.

– Ireland: Strong safeguarding and quarterly XBRL returns; timelines can stretch.

– Cyprus: On-site inspection common before approval.

– Malta: In-principle stage; 2025 fee revisions.

– Germany/Spain: Conservative, thorough processes.

Basic Requirements to Apply

All EMI applications must follow EBA/GL/2017/09. Key items include:

– Programme of operations & business plan (3-year financials).

– Governance: fit & proper directors, MLRO/Compliance, internal audit.

– Capital: €350k full EMI.

– Safeguarding arrangements (segregated accounts or insurance).

– Risk management: AML/CTF, IT, fraud, outsourcing.

– Policies & manuals: 20–40 docs typically (AML, BCP, complaints, ICT security, etc.).

– Local presence: effective management and staff in-country.

Country-by-Country at a Glance

| Country | EMIs (≈) | Application Fee | Timeline | Notes |

| Lithuania | 80 | €1,463 | 3–6 mo | Pro-fintech, CENTROlink |

| Ireland | 27–28 | €0 | 6–12+ mo | Robust gatekeeper, XBRL reporting |

| Malta | ~30 | €10,000 | 6–9 mo | In-principle stage, fees revised 2025 |

| Cyprus | ~25 | €5,000 | 6–12+ mo | On-site checks common |

| Germany | ~12 | €5–10k | 9–18+ mo | Conservative review |

| Spain | ~12 | €5–10k | 9–18+ mo | Thorough review |

References

- Bank of Lithuania – EMI statistics & fees.

- Central Bank of Ireland – EMI authorisation guidance.

- MFSA Malta – EMI licensing fees (2025 revisions).

- Central Bank of Cyprus – EMI application fees.

- BaFin Germany – EMI register.

- Banco de España – EMI register.

- EBA – Guidelines on Authorisation (EBA/GL/2017/09).