When comparing licensing options for fintech businesses, two factors dominate: 1) how long it typically takes to obtain approval, and 2) what the all‑in (bulk) first‑year budget looks like.

This guide compares four regimes:

• UK EMI (FCA)

• EU EMI (e.g. Lithuania, Ireland, Germany)

• Canada MSB (FINTRAC)

• UAE VASP (VARA Dubai / ADGM)

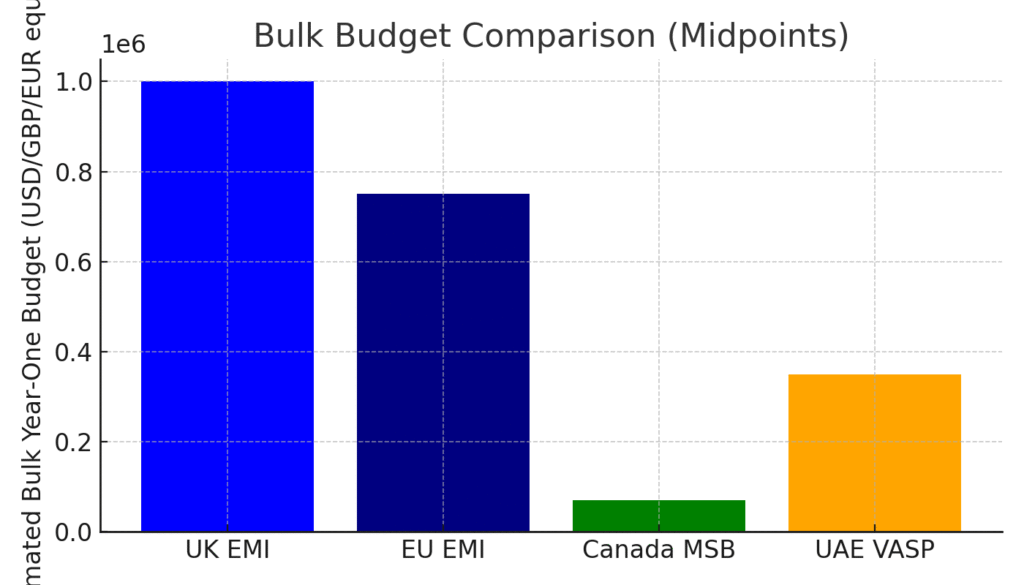

Bulk cost refers to the total realistic budget credible operators spend in Year One — including advisory, compliance, tech, staffing, banking, and regulator fees — beyond the official application fee.

Side‑by‑Side: Time & Bulk Cost

| Regime | Regulator | Official Fee | Capital Minimum | Typical Timeline | Bulk Year‑One Budget |

| UK EMI | FCA (UK) | £5k small | €350k | 6–12 months | £750k–1.2m |

| EU EMI | Local NCAs (e.g. Lithuania, Ireland, BaFin) | €5k–10k [2] | €350k | 9–18 months | €500k–1m |

| Canada MSB | FINTRAC (Canada) | CAD $0 [3] | None (federal) | 6-12 months | USD $40k–100k+ |

| UAE VASP | VARA Dubai / ADGM | USD 15k–50k [4] | AED 1m+ (scope‑dependent) | 6-12 months | USD $200k–500k+ |

Notes: Timelines depend on application quality, jurisdiction workload, and scope of activity. Bulk budgets are realistic ranges for credible operators; high‑risk models (e.g., exchanges) trend toward the upper end.

Visual: Bulk Year‑One Budget

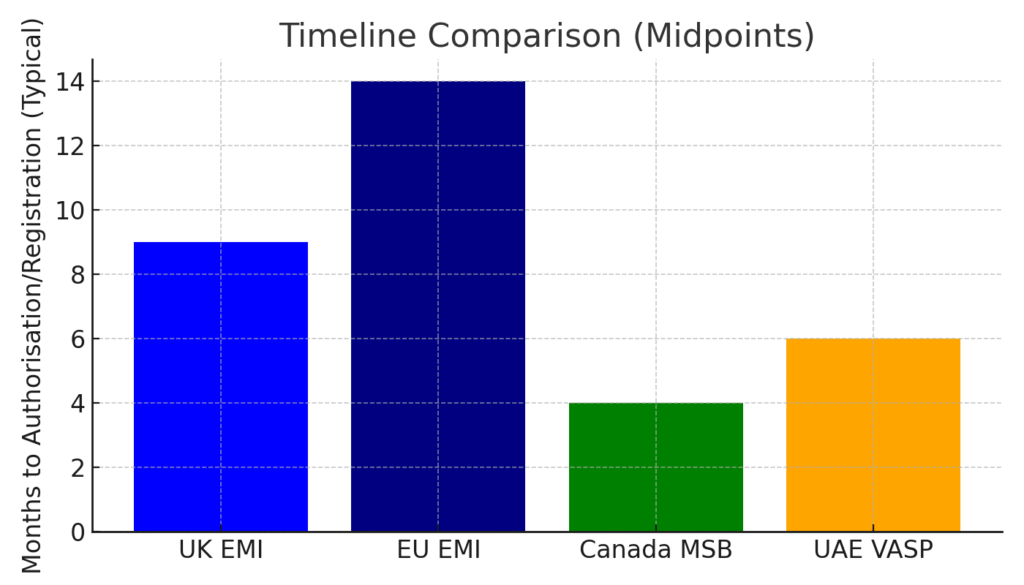

Visual: Typical Timelines

Jurisdiction Notes

UK EMI (FCA)

• Official fee: £5k [1].

• Capital: €350k (full EMI).

• Timeline: 6–12 months. FCA is documentation‑heavy (30+ policies/manuals).

• Bulk cost: £750k–1.2m for advisory, compliance staff, safeguarding, AML systems, audits and Capital.

EU EMI (e.g. Lithuania, Ireland, BaFin)

• Official fee: €5k–10k [2].

• Capital: €350k (full EMI).

• Timeline: 9–18 months, depending on NCA. Lithuania fastest, Ireland and BaFin often slower.

• Bulk cost: €500k–1m realistic Year One, lower than UK in some markets but slower to process.

• Notes: Passporting across EU remains a key advantage.

Canada MSB (FINTRAC)

• Official fee: CAD $0 (federal registration) [3].

• Capital: None federally (banks still expect financial resilience).

• Timeline: 6+ months (incorporation + FINTRAC review).

• Bulk cost: USD $40k–100k+, including incorporation, compliance officer, AML tools, training.

UAE VASP (VARA Dubai / ADGM)

• Official fee: USD 15k–50k depending on category [4].

• Capital: AED 1m+ for most categories, higher for exchanges.

• Timeline: 6+ months, depending on scope and regulator.

• Bulk cost: USD $200k–500k+ for a modest operation; higher for high‑risk models.

References

- [1] FCA – Authorisation and registration application fees. https://www.fca.org.uk/firms/authorisation/apply/fees

- [2] Central Bank of Lithuania – EMI licensing guidelines. https://www.lb.lt/en/sfi-financial-market-participants

- [3] FINTRAC – Register your money services business. https://fintrac-canafe.canada.ca/msb-esm/register-inscrire/reg-ins-eng

- [4] VARA – Licence applications & fee schedules. https://www.vara.ae/en/licenses-and-register/licence-applications/