In today’s fintech world, entrepreneurs often face a strategic choice between establishing an Electronic Money Institution (EMI) in Europe/UK or registering as a Money Services Business (MSB) in the US/Canada. Both structures enable companies to handle payments, remittances, and digital finance operations, but their cost, scope, and regulatory weight differ significantly.

This article breaks down the official pricing, the hidden expenses, and the realistic budget entrepreneurs should plan for.

What is an EMI?

An Electronic Money Institution (EMI) is a fully regulated license under the EU/UK frameworks (PSD2, EMR 2011, FCA PSRs 2017). It allows:

– Issuing e-money.

– Opening IBAN accounts for clients.

– Issuing payment cards.

– Providing payment services across the EEA/UK.

EMIs are regarded as one of the highest standards of non-bank licensing in Europe.

What is an MSB?

A Money Services Business (MSB) is a registration (not a license) with FinCEN (US) or FINTRAC (Canada). It covers:

– Money transmission and remittances.

– Foreign exchange dealing.

– Payment processing.

– Certain crypto-related services (depending on jurisdiction).

MSBs are faster and cheaper to establish, but carry less market value and face more restrictions from banks.

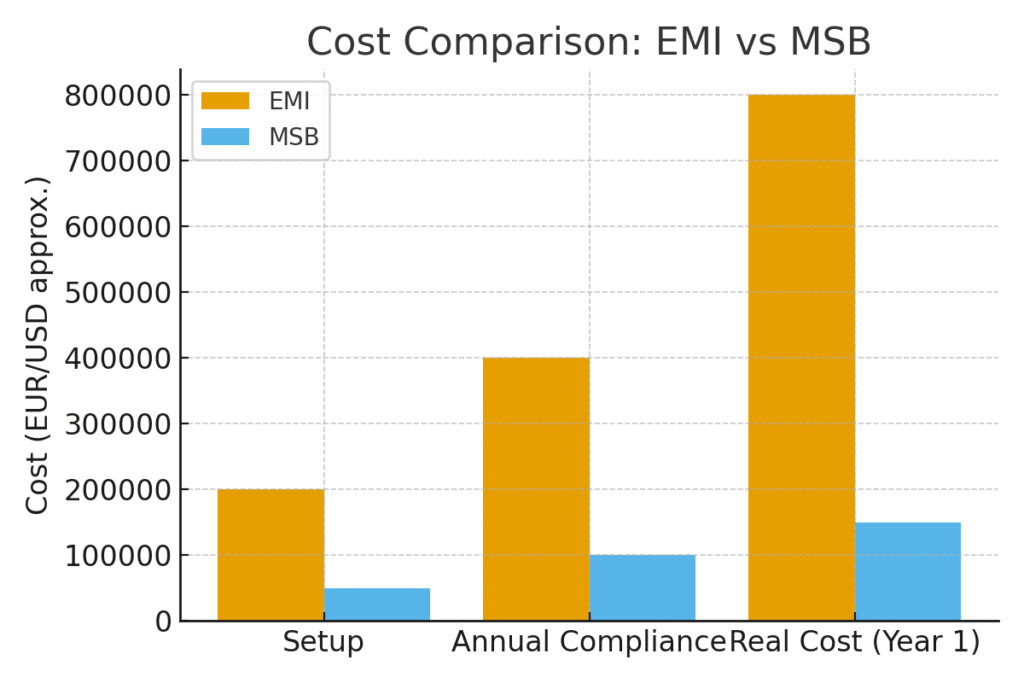

Comparing Costs: EMI vs MSB

| Feature | EMI (EU/UK) | MSB (US/Canada) |

| Regulator | FCA, BaFin, Central Banks | FinCEN (US), FINTRAC (Canada) |

| Application Fee | €5,000–25,000 | $0–2,000 |

| Capital Requirement | €350,000 (full EMI) | None |

| Legal & Advisory Setup | €100,000–250,000 | $20,000–50,000 |

| Annual Compliance | €200,000–500,000+ | $50,000–150,000 |

| Banking Costs | Safeguarding accounts €5k–20k/month | Correspondent banking 0.25–2% per txn |

| Time to License | 6–12 months | 2–3 months |

Beyond the Numbers: Real Costs & Operational Burden

– Banking Access: EMIs must hold safeguarding accounts with Tier-1 banks. These accounts alone can cost €60,000–250,000 per year, plus stringent compliance requirements. MSBs, on the other hand, often rely on correspondent banking or payment processors who charge high transactional fees.

– Staffing & Compliance:

– EMI: Mandatory compliance officer, internal auditor, directors with local presence. Expect to spend €150,000–300,000 annually on people alone.

– MSB: A Money Laundering Reporting Officer (MLRO) and compliance support, typically $50,000–80,000 annually.

– Technology & Infrastructure:

– EMI: Core banking system, transaction monitoring, card issuing platforms. Often €100,000+ setup, with ongoing monthly costs.

– MSB: Lighter IT stack, can operate on payment processors’ infrastructure.

The Whisper: The Real Cost of Licensing

While regulators often state official fees and minimum capital, the real budget tells a different story.

– EMI (EU/UK): Realistically, an entrepreneur should expect €500,000–1,000,000 to obtain and operate an EMI license for the first year. This includes legal structuring, compliance hiring, banking set-up, technology, and the capital requirement.

– MSB (US/Canada): Despite the low entry fees, a credible MSB setup typically costs $80,000–200,000 for year one, including advisory, compliance program, and banking partners.

The key takeaway: the stated government fees are just the tip of the iceberg — the true challenge (and cost) lies in building banking relationships, hiring compliance professionals, and implementing technology.

Which Model Fits You?

– Choose an EMI if you want to:

– Offer IBAN accounts and card programs.

– Scale across Europe.

– Build long-term value with strong regulatory credibility.

– Choose an MSB if you want to:

– Start quickly and at lower cost.

– Focus on remittances, crypto on/off ramps, or niche payments.

– Test the market before investing in a full license.

Conclusion

Both EMIs and MSBs open the door to the financial services world, but their pricing, credibility, and operational complexity are worlds apart. An EMI is a long-term investment — expensive, but highly rewarding in terms of market trust and scalability. An MSB is a leaner option — faster, cheaper, but often constrained by banking and investor limitations.

When budgeting, remember: the true cost is not in the government fee, but in building the compliance, banking, and operational backbone that makes your license valuable.

Visual Comparison: EMI vs MSB

The chart below illustrates a high-level cost comparison between EMIs and MSBs.

FAQs

1. What is the main difference between an EMI and an MSB?

An EMI (Electronic Money Institution) is a full financial license regulated in the EU/UK, allowing issuance of e-money and IBAN accounts. An MSB (Money Services Business) is a registration in the US/Canada that covers money transmission and remittance services but offers fewer capabilities.

2. How much does it cost to set up an EMI license compared to an MSB registration?

An EMI setup typically costs between €500,000 and €1,000,000 in the first year, including capital and operational expenses. An MSB registration is more affordable, averaging $80,000–$200,000 in total first-year costs.

3. Which is faster to obtain — an EMI or an MSB?

An MSB can usually be registered within 2–3 months, while obtaining an EMI license can take 6–12 months due to more rigorous regulatory and due diligence requirements.