Introduction: Why Licensed Entities Matter More Than Ever

The global fintech and payments ecosystem is rapidly evolving. Whether you’re a startup aiming to enter new markets or an investor seeking regulated opportunities, one challenge remains consistent: you need the right license.

From Money Services Business (MSB) registrations in Canada or the U.S. to Electronic Money Institution (EMI) licenses in the UK and Europe, and from Payment Institution (PI/PSP) permissions to Virtual Asset Service Provider (VASP) frameworks across Asia and the Middle East—the choices can feel overwhelming.

That’s why companies often ask:

Should we buy an existing licensed company?

Should we apply for our own license?

Or should we partner/referral with a licensed provider?

This guide breaks down all three options—buying, building, and partnering—so you can decide which path fits your growth strategy. We’ll also explore how to sell a licensed entity, how referral models typically work, and what hidden costs you should budget for.

At 7BaaS, we specialize in White-Label Banking, Fintech Licensing & Compliance solutions, helping clients worldwide acquire, build, or scale their licensed businesses.

License Types at a Glance

Before comparing strategies, let’s simplify the license landscape:

-

MSB (Money Services Business): Covers money transmission, FX services, prepaid, and in some cases, crypto transactions. Common in Canada, U.S., and certain LATAM markets.

-

PI/PSP (Payment Institution/Service Provider): Enables payment processing without issuing e-money. Often a stepping stone for fintechs entering Europe, Asia, or Middle East markets.

-

EMI (Electronic Money Institution): Required if you plan to issue e-money, prepaid cards, or wallets. Popular in the UK, EU, and certain global jurisdictions.

-

VASP (Virtual Asset Service Provider): For businesses offering crypto custody, exchange, or transfer. Now regulated in markets like Dubai (VARA), Singapore (MAS), and Hong Kong (SFC/HKMA).

For a deeper dive into licenses and frameworks, see 7BaaS Fintech Licensing Services.

Go-to-Market Strategies

There are three main routes to market with regulated capabilities:

1. Buy an Existing Licensed Company

-

Fastest entry if you acquire a clean, banking-ready entity.

-

Includes license, legal entity, policies, and sometimes banking relationships.

-

Best suited for investors, international entrants, or fintechs with capital but no time to wait for new approval.

2. Build (New Application/Registration)

-

Incorporate a new company and apply for the license from scratch.

-

Offers full control, but can take 6–12 months+ depending on jurisdiction.

-

Requires a complete compliance stack (policies, CCO/MLRO, AML tech, audit).

3. Partner / Sponsor / Referral

-

Operate under another license holder’s umbrella as an agent, distributor, or referral partner.

-

Quick to market (1–3 months), low upfront costs.

-

Trade-off: lower margins and limited independence.

Tip: Many 7BaaS clients start with referral/partnership models to test markets, then move into their own license or acquisitions once revenues grow.

Buying an MSB-Licensed Company: What You Really Get

When you purchase an MSB (or another licensed company), you typically acquire:

-

Entity + License/Registration

-

Banking relationships (if included in the sale)

-

Compliance framework (policies, procedures, training)

-

Staff & infrastructure (sometimes a ready team)

-

Technology stack (transaction monitoring, onboarding systems)

-

Existing revenues & clients

Core Due Diligence Checklist

-

Regulatory: Active license status, scope, audit history, pending findings.

-

Compliance: Policy maturity, QA results, STR/SAR history, ongoing training.

-

Financials: Revenue, margin, client mix, reserves, chargebacks.

-

Operations & Tech: Vendor contracts, transaction monitoring tools, data retention.

-

Banking/Partners: Safeguarding arrangements, correspondent relations, fee schedules.

Valuation Drivers

-

Clean compliance track-record

-

Active banking partnerships

-

Strong operational readiness

-

Existing client base with recurring revenue

Pros:

✔ Speed to market

✔ Credibility with partners & regulators

✔ Revenue-generating on day one

Cons:

✖ Premium pricing

✖ Integration challenges

✖ Legacy compliance risks

Learn more in our post: The Real Price of an MSB License in Canada.

Selling an MSB-Licensed Company

If you’re on the other side and looking to exit, preparation is key.

How to Prepare for a Sale

-

Close outstanding compliance audit points.

-

Keep financials clean and up-to-date.

-

Document monitoring and AML efforts.

-

Ensure your regulatory file is free from pending investigations.

Typical Process

-

NDA & teaser

-

Information pack + data room

-

Indicative offers

-

Confirmatory due diligence

-

SPA (share purchase agreement)

-

Regulatory approval for change of control

Pricing Factors

-

Revenue and EBITDA multiples

-

Premium for active banking relationships

-

Premium for “pristine” compliance record

Referral & Broker Models: How They Work

Not ready to buy or build? Referral and broker models can help you generate income or scale quickly.

Common structures:

-

Flat referral fee per onboarded client

-

Tiered success fee on transaction volumes

-

Recurring revenue share

⚠️ Important: Referrers must never present themselves as the license holder. Contracts should clarify:

-

Marketing permissions

-

KYC ownership

-

Liability split

Explore partnership options with 7BaaS Referral & White-Label Banking.

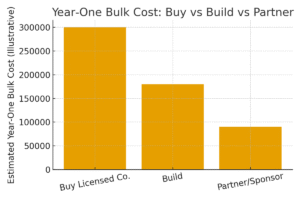

Buy vs Build vs Partner: Quick Comparison

| Path | Speed to Market | Control & Margin | Capex (Year 1) | Key Risks |

|---|---|---|---|---|

| Buy Licensed Company | 2–6 months | High | Medium-High (+purchase price) | Legacy compliance, integration |

| Build (New License) | 6–12+ months | Highest | High | Regulator iterations, banking access |

| Partner/Referral | 1–3 months | Low–Medium | Low–Medium | Sponsor dependency, limited scope |

Hidden Costs You Should Budget

Even experienced operators underestimate costs. Watch out for:

-

Compliance staffing: CCO/MLRO, internal audit, training.

-

Monitoring tools: Screening, transaction monitoring, case management.

-

Banking/processor fees: Setup + monthly minimums can exceed regulator fees.

-

Advisory & legal fees: Especially for change-of-control approvals.

-

Legacy remediation: Cleaning up past issues when buying a company.

Case Scenarios: Which Path Is Right for You?

-

Startup Fintech: Start with partner/sponsor model, then build your own license.

-

International Entrant: Buy a licensed company for speed and credibility.

-

Investor/Exit Planning: Clean up compliance and sell at a premium.

Conclusion: Making the Right Move

The choice between buying, building, or partnering depends on your capital, risk appetite, and market strategy. No matter which path you take, regulatory compliance, strong banking relationships, and operational readiness are non-negotiable.

At 7BaaS, we help clients worldwide buy, sell, and scale licensed financial entities—from MSBs in North America to EMIs in the UK, PI/PSPs in the EU, and VASPs in the Middle East & Asia.

Ready to explore your options?

Contact 7BaaS Today and let’s find the best path for your business.