Introduction: Why Canada Is Becoming a Strategic Hub for Virtual Asset Businesses

The rise of digital assets has transformed how modern financial systems operate. For entrepreneurs, fintech founders, and global crypto operators, Canada has quietly become one of the most attractive jurisdictions to launch a Virtual Asset Service Provider (VASP). With clear regulatory frameworks, a strong banking system, and a reputation for stability, Canada offers an environment where innovative crypto businesses can grow while maintaining compliance and credibility.

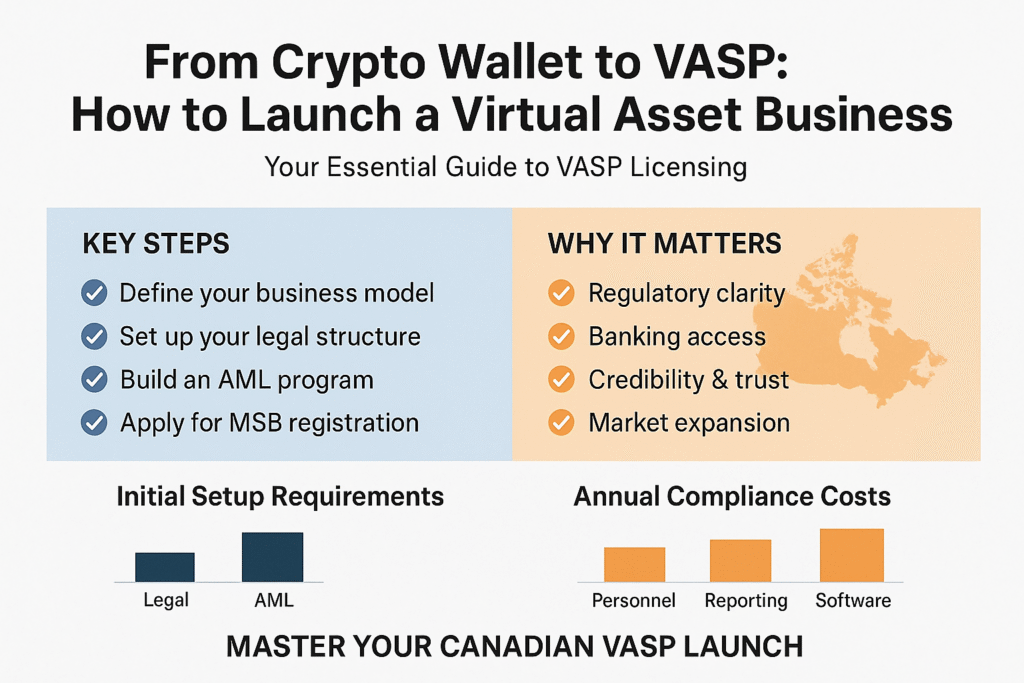

But launching a VASP in Canada is not as simple as building a crypto wallet or exchange platform. It requires structured planning, regulatory approval, a robust anti-money laundering (AML) program, transparent governance, and a well-defined business model tailored to the Canadian market.

This guide walks you through exactly how to launch a Virtual Asset Business in Canada — from concept to compliant VASP operation. Whether you’re upgrading a simple crypto wallet app into a fully registered entity or expanding your global digital asset brand into Canada, this comprehensive roadmap ensures you understand every step.

1. What Is Considered a VASP in Canada?

A Virtual Asset Service Provider (VASP) generally refers to businesses that deal with digital assets such as Bitcoin, Ethereum, stablecoins, and tokenized assets. In Canada, VASPs fall under the broader category of Money Services Businesses (MSBs) if they provide any of these services:

Virtual Currency Exchange

Buying, selling, or converting one type of digital asset into another or into fiat currency.

Virtual Currency Transfer Services

Sending or receiving digital assets on behalf of customers.

Custodial Wallet Services

Holding customer funds in a managed wallet or private key environment.

Crypto Payment Processing

Helping businesses accept crypto payments for goods or services.

Crypto ATM Operations

Managing kiosks that allow users to buy or sell cryptocurrency.

If your business performs any of these activities, you will be classified as a VASP/MSB and must comply with Canadian AML laws.

2. Why Canada Is a Prime Jurisdiction for VASP Launch

There are several reasons crypto founders globally choose Canada as a launchpad:

Clear Regulatory Environment

Unlike many jurisdictions where crypto regulations remain vague, Canada provides specific definitions and requirements for digital asset businesses.

Favorable Banking and Financial Ecosystem

Canadian banks and fintechs are increasingly open to digital asset businesses — provided compliance standards are met.

A Strong Market With High Crypto Adoption

Canada has one of the world’s highest per-capita crypto adoption rates, making it ideal for exchanges, wallets, and digital payment products.

Global Expansion Opportunities

A compliant Canadian VASP improves your credibility when entering the U.S., UAE, and European markets.

3. Step One: Define Your VASP Business Model

Before applying for registration, clarify your business scope. Different VASP models have different requirements:

A. Crypto Exchange / Swap Platform

Facilitate buying, selling, or trading assets.

B. Custodial Wallet Provider

Store private keys or digital assets for customers.

C. Crypto Payment Gateway

Allow merchants to accept cryptocurrency.

D. OTC Desk or Brokerage

Provide high-volume, personalized crypto trades.

E. Multi-Service VASP

Combine multiple offerings (wallet + exchange + transfers).

Your business model will determine:

- Compliance program structure

- Technology infrastructure

- Risk assessment requirements

- Capital needs

- Banking and liquidity planning

Take time here — a clear model speeds up licensing later.

4. Step Two: Set Up Your Legal Structure in Canada

To operate as a VASP/MSB, you must:

Incorporate a Canadian Business Entity

This can be a federal corporation or a provincial corporation.

Document Ownership Transparently

You must disclose shareholders, directors, and anyone owning 20% or more of the company.

Appoint a Compliance Officer

This person is responsible for implementing and managing the AML program.

Prepare Corporate Governance Documents

Including articles of incorporation, shareholder registers, and director information.

Strong corporate structure reduces delays during registration.

5. Step Three: Build Your AML/KYC Compliance Program

Launching a VASP in Canada requires a fully developed AML compliance program before applying.

Your program must include:

1. Policies and Procedures

Explain how your business prevents money laundering and terrorist financing.

2. KYC and Customer Due Diligence Rules

How you will verify customer identities, monitor transactions, and detect unusual activity.

3. Risk Assessment

Detail risks related to crypto volatility, anonymity, cross-border transfers, etc.

4. Ongoing Monitoring Procedures

Describe how you will track suspicious patterns and large transactions.

5. Record-Keeping Policies

Include data retention, customer files, and transaction logs.

6. Training Program

Train employees regularly on AML obligations and updates.

7. Independent Review System

Your AML program must be reviewed at least every two years.

Crypto businesses without strong AML frameworks face immediate rejection—this is the most important step for VASPs entering Canada.

6. Step Four: Develop Robust Technical Infrastructure

Your technology stack must match your business model. A Canadian VASP typically requires:

1. Secure Wallet Infrastructure

Custodial, non-custodial, or hybrid solutions with multi-signature and cold storage options.

2. Exchange Engine and Order Matching

If you run a trading platform.

3. Transaction Monitoring System

Detects suspicious wallet behavior or unusual movement patterns.

4. Blockchain Analytics Tools

Used to screen wallet addresses and prevent illicit activity.

5. API Integrations with Banking & Liquidity Providers

To support fiat on-ramps and off-ramps.

6. High-Availability Architecture

Ensures uptime — critical for exchanges and wallets.

7. Data Security & Encryption Controls

Protect user wallets, private keys, and sensitive information.

Technical readiness is evaluated during compliance checks, so document your architecture thoroughly.

7. Step Five: Apply for MSB Registration

To legally operate as a VASP, you must register your business as a Money Services Business (MSB).

The registration requires:

- Full business details

- Corporate documents

- Ownership and management information

- AML compliance program

- Criminal record checks

- Banking details

- Detailed business model explanation

- Agent or branch information (if any)

The review timeline typically ranges from a few weeks to several months, depending on complexity.

Once approved, you receive:

- An official MSB Registration Number

- Inclusion in the public MSB registry

- Authorization to operate legally in Canada

This is your regulatory foundation.

8. Step Six: Financial Partnerships and Banking Setup

Crypto businesses must maintain a strong relationship with:

Commercial Banks

For corporate accounts and fiat operations.

Payment Processors

To support card payments, deposits, or merchant payouts.

Liquidity Providers

For exchanges or OTC desks.

Banks will request:

- Your MSB registration

- AML policies

- Compliance controls

- Nature of operations

- Source of funds

Early onboarding with a crypto-friendly financial institution speeds up market entry.

9. Step Seven: Build a Secure Operational Framework

Beyond compliance, a functional VASP requires strong internal controls:

Internal Governance Policies

Clear responsibilities for executives, compliance officers, and technology teams.

Cybersecurity Framework

Threat detection, penetration testing, private key management, and incident response plans.

Insurance Coverage

Some VASPs acquire digital asset crime insurance or operational liability insurance.

Customer Support Operations

Handling onboarding, disputes, withdrawals, and security incidents.

Liquidity and Treasury Management

Ensures smooth transaction flows and exchange operations.

Launching a VASP is not only a legal exercise but an operational transformation.

10. Step Eight: Launch and Scale Your Crypto Product

After obtaining your MSB license and completing integrations, you can soft-launch your platform.

A. Beta Testing

Start with limited users to test wallet flows, deposits, withdrawals, and KYC procedures.

B. Regulatory Notifications

Keep regulators updated about material changes.

C. Marketing with Compliance

Avoid promising unrealistic returns or guaranteed profits.

D. User Education

Provide learning materials on crypto risks and security best practices.

E. Scaling Across Canada and Globally

Once stable, expand into new provinces and international markets.

11. Key Mistakes New VASPs Make — and How to Avoid Them

Many startups fail because they:

1. Underestimate Compliance Complexity

MSB and AML requirements must be mastered before launch.

2. Lack a Clear Custody Model

Not defining hot vs. cold wallet policies is a red flag.

3. Use Weak KYC Tools

Regulators expect world-class identity verification.

4. Delay Banking Relationships

Banks reject incomplete applications.

5. Ignore Cybersecurity Architecture

Crypto platforms are prime hacking targets.

6. Hire Inexperienced Compliance Staff

Canadian AML requirements are unique and strict.

7. Expand Too Quickly

Launch in phases to avoid scalability issues.

Avoiding these pitfalls saves both time and capital.

12. Why Going From a Wallet App to a Full VASP Is a Strategic Move

Many founders begin with simple wallet apps because they avoid heavy compliance obligations. But scaling requires:

- Fiat on-ramps

- Crypto-to-crypto exchange

- International remittances

- Institutional services

- Merchant solutions

These services cannot operate legally without VASP/MSB registration.

Becoming a licensed VASP opens the door to:

Institutional clients

Banks, funds, and enterprises prefer regulated providers.

Global partnerships

Licensing builds credibility abroad.

Product diversification

Move beyond basic wallets into lending, staking, payments, or OTC trading.

Long-term business sustainability

Regulation reduces operational risk.

13. The Future of VASPs in Canada

Canada continues to strengthen its digital asset framework. Expected developments include:

1. Enhanced rules for custody providers

More requirements around cold storage and asset segregation.

2. Stricter reporting standards

Especially for high-risk transactions.

3. Integration of stablecoin regulations

To manage risks from asset-backed and algorithmic stablecoins.

4. Payment modernization

New legislation will affect crypto-based payment services.

5. Increased scrutiny of foreign VASPs

Global operators targeting Canadians will face more compliance checks.

Those who build compliant foundations today will thrive tomorrow.

Conclusion: Turning Your Crypto Vision Into a Regulated Canadian VASP

Launching a Virtual Asset Business in Canada is both an opportunity and a responsibility. Entrepreneurs entering this market must balance innovation with compliance — but with the right planning, you can build a powerful, credible, and scalable digital asset enterprise.

From defining your business model to implementing a strong compliance program and securing MSB registration, each step contributes to your long-term success. Canada’s regulatory clarity, mature financial sector, and strong crypto adoption make it a prime destination for digital-asset innovation.

If executed correctly, transforming your crypto wallet idea into a fully compliant VASP in Canada is not only achievable — it is one of the most strategic moves for long-term growth in the global digital asset economy.

References:

- 7BaaS – Fintech Infrastructure & Licensing Guidance

https://7baas.com - 7BaaS Insights – Fintech, MSB, and Licensing Articles

https://7baas.com/insights/