Introduction

As global fintech and cross-border payments expand, entrepreneurs and investors face one recurring question: How much does it cost to set up a money services business (MSB) or payment service provider (PSP)? While the potential for growth is undeniable, navigating licensing frameworks is complex and costly. The UK, Canada, and UAE stand out as three of the most popular regulatory destinations, but each comes with its own set of fees, capital requirements, compliance obligations, and hidden operational expenses.

This blog breaks down what you should realistically expect when budgeting for an MSB or PSP licence in each jurisdiction — beyond the official regulator fees. We cover the true cost of entry, from capital requirements to compliance overheads, drawing insights from official regulators, industry experts, and advisors like 7BaaS, Buckingham Capital Consulting, WeFormOnline, and PayCompliance.

United Kingdom: EMI / PSP-Like Licences (FCA)

The UK remains one of the most prestigious financial markets in the world, with strong consumer trust, access to SEPA/SWIFT, and global credibility for fintech businesses. However, it is also one of the most expensive to enter.

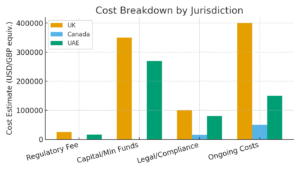

Official Costs

- FCA Application Fee: £5,000 for a Small EMI licence; ~£25,000 for a Full EMI licence .

- Capital Requirement: €350,000 (~£300,000) for Full EMI authorisation, per PSD2/EMR.

Operational & Hidden Costs

- Legal & Advisory: £60,000–150,000+ for drafting, application submission, and regulator communications.

- Safeguarding Accounts: £60,000–250,000 annually depending on bank partnerships.

- Compliance Staffing: £200,000–300,000 annually (compliance officer, MLRO, reporting).

- Technology Stack: £100,000–250,000 to launch platforms that meet FCA standards.

Whisper Cost

- Realistic Year-One Budget: £750,000–1,200,000 .

The FCA expects firms to demonstrate not just financial strength but robust compliance systems. For most startups, the combination of advisory fees, staffing, and safeguarding requirements drives costs far beyond the official licence fee.

Canada: MSB / Crypto MSB Registration (FINTRAC)

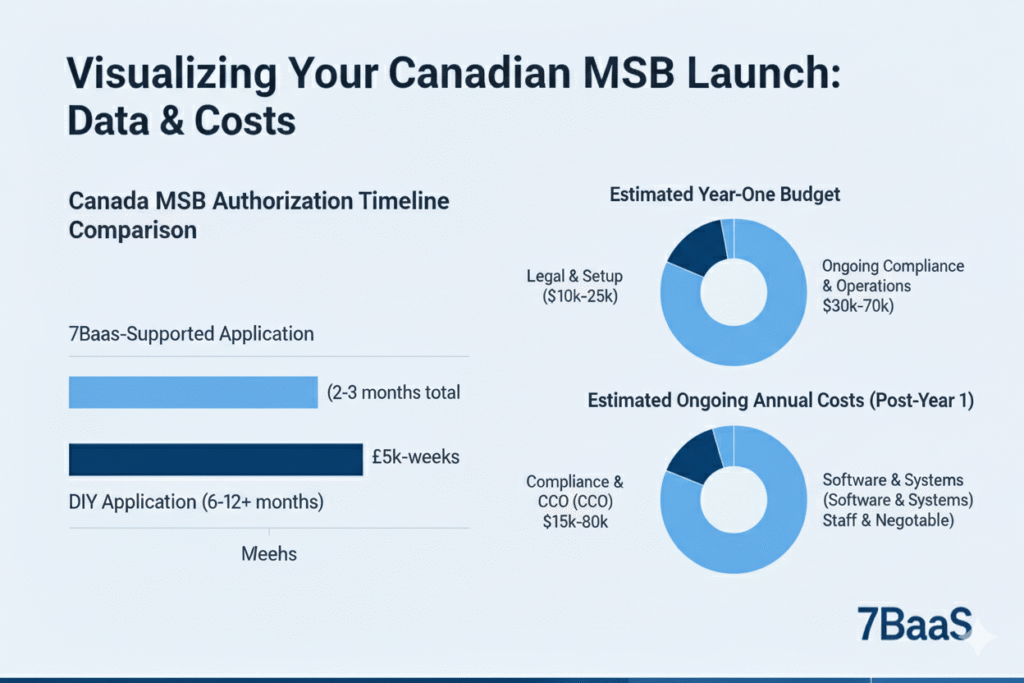

Canada is increasingly attractive for fintech startups due to its relatively low entry costs, straightforward process, and global recognition of its regulatory framework. Registration with FINTRAC (Canada’s AML regulator) is mandatory for MSBs.

Official Costs

- FINTRAC Registration Fee: CAD $0

- Quebec Licence (if operating in Quebec): CAD $1,000–2,500 .

Operational & Hidden Costs

- Incorporation: CAD $200–300 for federal incorporation .

- Legal & Application Support: USD 3,000–8,000 depending on scope.

- Compliance Documentation: USD 5,000–15,000 (AML/KYC manuals, policies, training).

- Ongoing Compliance: USD 30,000–80,000 annually (reporting, audits, MLRO fees).

Timeline

- Incorporation: 1–2 weeks.

- FINTRAC review: 4–6 weeks.

- Total Timeframe: ~2–3 months [5].

Whisper Cost

- Realistic Year-One Budget: USD 40,000–100,000+ [6].

Canada’s model makes it attractive for startups testing cross-border remittances, crypto-to-fiat services, or early-stage fintech products, though scaling internationally may require additional licensing.

UAE: PSP / Money Services (ADGM / DIFC / Mainland)

The UAE has positioned itself as a fintech hub bridging Europe, Asia, and Africa. Two free zones — Abu Dhabi Global Market (ADGM) and Dubai International Financial Centre (DIFC) — are the primary destinations for fintech licensing, alongside Central Bank (CBUAE) licences for larger operations.

Official Costs

- ADGM: Category licences cost ~USD 16,700 initial + ~USD 16,200 annual renewal .

- DIFC: PSP licence ~USD 15,000+ for application and authorisation .

- Mainland (CBUAE): Higher costs, including AED 1m+ in capital requirements.

Operational & Hidden Costs

- Legal & Compliance: USD 50,000–150,000+ for application support and ongoing obligations.

- Technology & Integration: Banking partnerships, card processors, and payment gateways.

- Local Staffing: Required under DIFC/ADGM rules, adding significant costs.

Whisper Cost

- Realistic Year-One Budget: USD 200,000–400,000 (free zones).

- Complex/Crypto Activities: USD 500,000+ [10].

The UAE’s flexible but stringent frameworks make it attractive for regional operations, but entry costs are considerably higher than Canada.

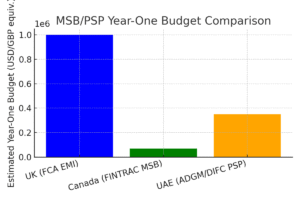

Side-by-Side Comparison

| Jurisdiction | Regulator | Official Fees | Capital Requirement | Year-One Whisper Cost |

|---|---|---|---|---|

| UK | FCA (Full EMI) | £5,000–25,000 | €350,000 (~£300,000) | £750k–1.2m |

| Canada | FINTRAC | CAD $0 (Quebec: $1,000–2,500) | None (but liquidity proof required) | USD 40k–100k |

| UAE | ADGM/DIFC/CBUAE | USD 15k–17k+ | Varies (AED 1m+ for Mainland) | USD 200k–500k |

Key Takeaways

- The UK is the gold standard for credibility but demands deep financial and operational readiness — budgets exceeding £1m are common.

- Canada offers the leanest entry into regulated fintech, with transparent processes and minimal upfront regulatory fees, making it popular for early-stage ventures.

- The UAE is a strategic regional hub, balancing prestige and cost — especially attractive for firms targeting MENA and Asia markets.

- Hidden costs often outweigh licence fees. Compliance staffing, technology, safeguarding, and banking access should be factored in at 3–5x the official licence fee.

For fintech founders, advisors like 7BaaS can streamline incorporation, regulatory documentation, and compliance frameworks to save time and reduce mistakes in the application process.

- Year-One Budget Comparison Chart: Side-by-side bar chart showing UK (£1m), Canada (USD 70k average), UAE (USD 300k average).

- Cost Breakdown Chart by Jurisdiction: Pie charts splitting official fees, legal/advisory, compliance, technology, and capital.

Conclusion

Choosing where to incorporate and licence your fintech operation depends on both budget and business strategy. If your priority is global credibility and European access, the UK remains unmatched — but requires £1m+ budgets. For lean startups testing models, Canada provides the most affordable and fastest route to licensing. Meanwhile, the UAE offers regional positioning at mid-to-high entry costs, particularly valuable for firms eyeing cross-border flows across MENA and Asia.

Before committing, founders should map their expansion strategy against realistic year-one costs, not just regulator fees. The smartest move is to over-budget, assume hidden expenses, and engage specialist advisors like 7BaaS to ensure compliance and faster go-to-market.